RIB Working Paper Series: RIB17-100005 Value at Risk and Expected Shortfall Estimation for China Securities Market

Article 325bb Expected shortfall risk measure | Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Assimilated Law) | Better Regulation

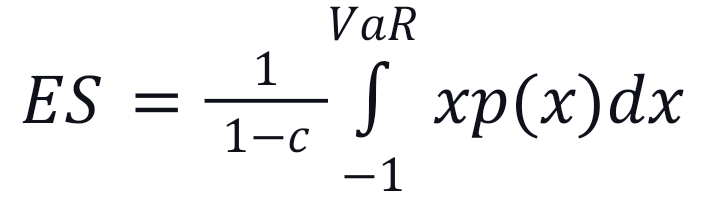

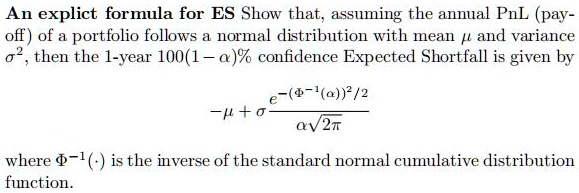

SOLVED: An explicit formula for ES: Show that, assuming the annual PnL (payoff) of a portfolio follows a normal distribution with mean μ and variance σ^2, then the 1-year 100(1-α)% confidence Expected

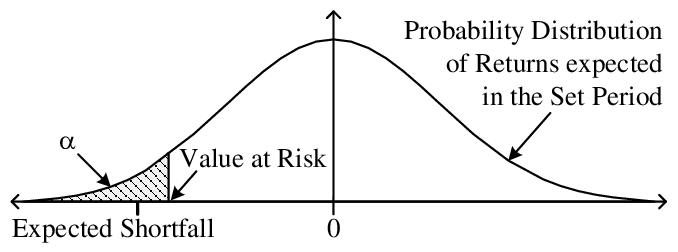

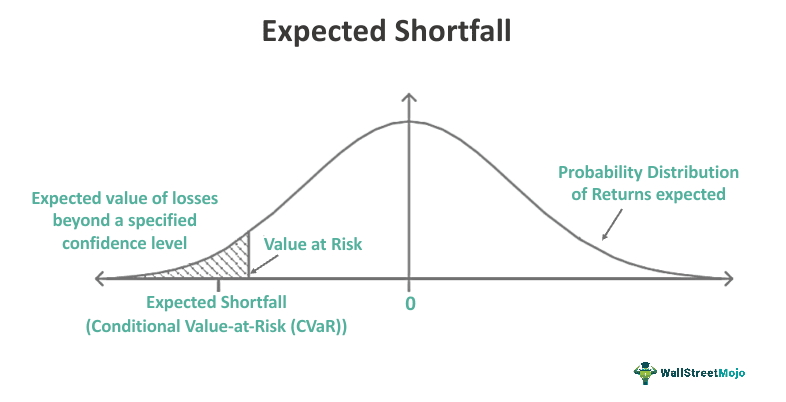

Understanding the paper “Expected Shortfall: a natural coherent alternative to Value at Risk” for the (almost) layman and through a hands-on Python approach – Software Developer – Capital Markets

Why is Expected Shortfall, not VaR, Sub-additive — a simple & intuitive explanation | by Kasa | Medium